- Independent dealers are struggling, with a low sentiment score of 37. This shows they’re facing serious financial problems and have a bleak outlook.

- 44% of dealers say political uncertainty is a big problem for their business. This is the highest level of concern since 2019.

- Many dealership staff don’t know enough about electric vehicles, which is hurting sales and pushing customers toward traditional cars instead.

It’s time for a reality check. The U.S. auto dealer market is in trouble, and it’s affecting everyone from small, independent shops to big franchise dealers. The latest Cox Automotive Dealer Sentiment Index (CADSI) shows a troubling trend: overall market sentiment dropped to 40 in Q3, down from 42 last quarter and 45 a year ago. Independent dealers are taking the biggest hit, with a sentiment score of just 37, the second-lowest ever recorded in the survey. Franchised dealers are slightly more hopeful at 50, but they’re still grappling with a market that’s as unpredictable as the political climate.

For over two years now, U.S. automobile dealers have viewed the market as weak, with Jonathan Smoke, Chief Economist at Cox Automotive, stating, “The retail auto business today is working through a lot of uncertainty, with the coming national election front and center, and also expectations of shifting market dynamics.”

ADVERTISEMENT

A Grim Outlook for Independent Dealers

Independent auto dealers are facing a tough situation, with market sentiment plummeting to just 37, their second-lowest score ever. With profits shrinking, sales dropping, and costs hitting record highs, many dealers are questioning if they can survive in a market that feels stacked against them. It’s like the system is set up to squeeze out these smaller players, leaving them struggling just to stay in business.

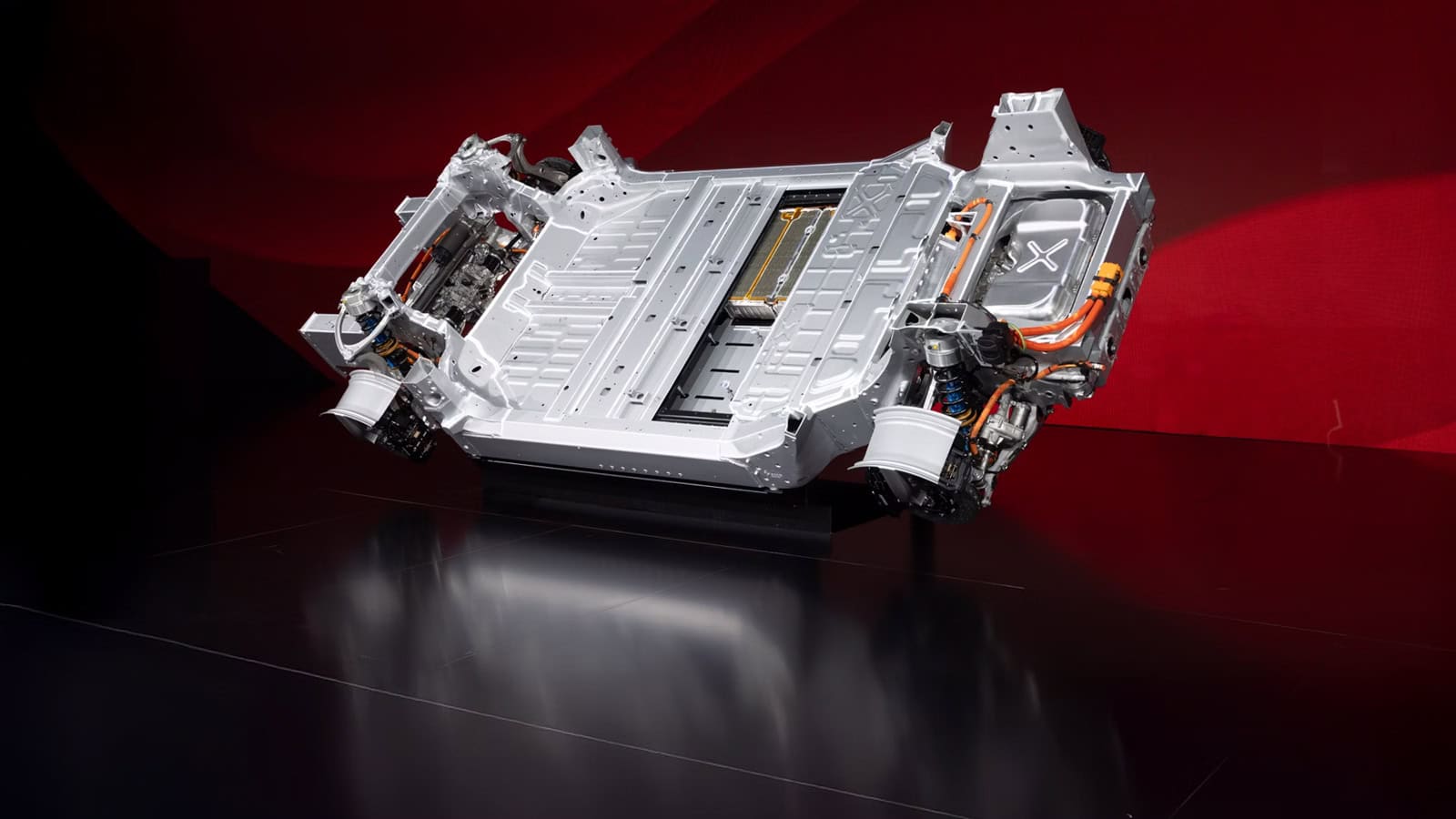

Franchised dealers aren’t feeling too optimistic either. Their profitability index has dropped to just half of what it was three years ago, showing a significant level of concern. What’s even more worrying is that the institutions expected to lead the transition to electric vehicles (EVs) are struggling to make it happen.

According to the CADSI report, while government incentives have boosted interest in EVs, expectations for the future are still declining. This is a deeper issue that limits innovation and reduces options for consumers.

The EV Knowledge Gap: A Barrier to Sales

There’s a major issue that isn’t getting enough attention: the knowledge gap among dealership staff. Many dealerships are still not equipped to sell electric vehicles effectively. Previously, we published an article that some dealerships are even undermining their own EV sales, whether by not training their staff properly or by intentionally pushing customers toward gas-powered cars.

It’s shocking that, in 2024, someone wanting to buy an EV could end up driving away in a gasoline car simply because the salesperson lacked the right information or was encouraged to promote traditional vehicles instead.

Laurance Yap, Vice President at Lithia and Driveway’s Greencars, said in an episode of Electrify Podcast, “If you walk into a dealership, and the salesperson doesn’t understand the difference between a plug-in hybrid and a battery electric vehicle, you’re not going to make the sale. And that’s a problem we need to fix immediately.”

Inventory Isn’t the Issue Anymore

One of the key takeaways from the CADSI report is that inventory levels are no longer a big issue for dealerships. The days of empty lots and frantic customers are behind us. But even with plenty of cars available, sales are still sluggish. Franchised dealers scored only 51 for new-vehicle sales this year, compared to 59 last year. So, what’s slowing things down? Why aren’t cars selling as quickly as expected?

The key is the pricing pressure index, currently at 66—a high score that shows dealerships are under more pressure than ever to lower prices. This directly affects their already slim profit margins. With operating costs at an all-time high, dealers face a tough choice: drop prices to sell inventory or hold firm and risk stagnant sales.

ADVERTISEMENT

The Political Climate and Economic Realities

Political uncertainty is heavily impacting dealer sentiment. According to the CADSI report, 44% of dealers now cite the political climate as a major factor hurting business, up from 36% in Q2. This is the highest level recorded since the survey started tracking this issue in 2019. Dealers are worried about how upcoming elections might influence policies affecting the auto industry, such as EV tax credits and regulations on emissions and fuel economy.

“The retail auto business today is working through a lot of uncertainty, with the coming national election front and center,” Smoke mentioned. Dealers are right to be concerned. Policy shifts could dramatically change the market landscape, affecting everything from consumer confidence to interest rates, which are already ranked as the second most significant factor holding back business.

Call to Action: The Need for Transparency and Innovation

Here’s the bottom line: the U.S. auto dealer market is at a critical point, and there’s a lot on the line. Independent dealers should have a fair shot in a market that often leans towards big companies and franchised networks. At the same time, consumers should have easy access to clear, reliable information about EVs, without having to go through misinformation or deal with salespeople who are uninformed or biased.

It’s time for auto dealers to step up. If you’re in the industry, invest in your team. Train them on EV technology, incentives, and long-term benefits. As a consumer, you should demand better. Don’t accept outdated practices that limit your options and harm the environment.

ADVERTISEMENT

IMAGES: ELECTRIFY EXPO

FTC: We use income-earning auto affiliate links. Learn more.