- CATL doesn’t just make batteries, but it also recycles 90% of lithium and nearly 100% of other raw materials like cobalt and manganese.

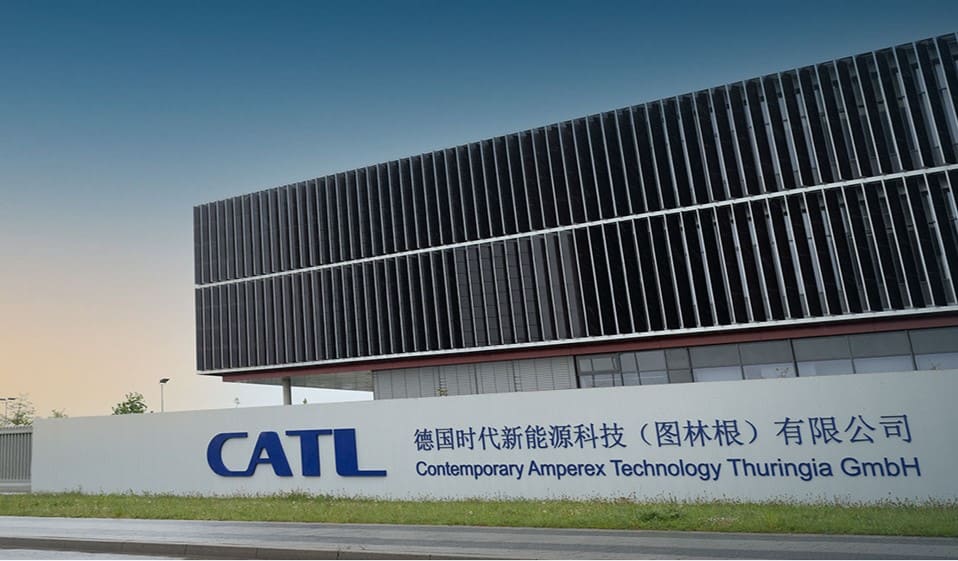

- The battery company has a gigafactory in Germany to help BMW and VW build new EVs and meet the European Union’s carbon emissions goals.

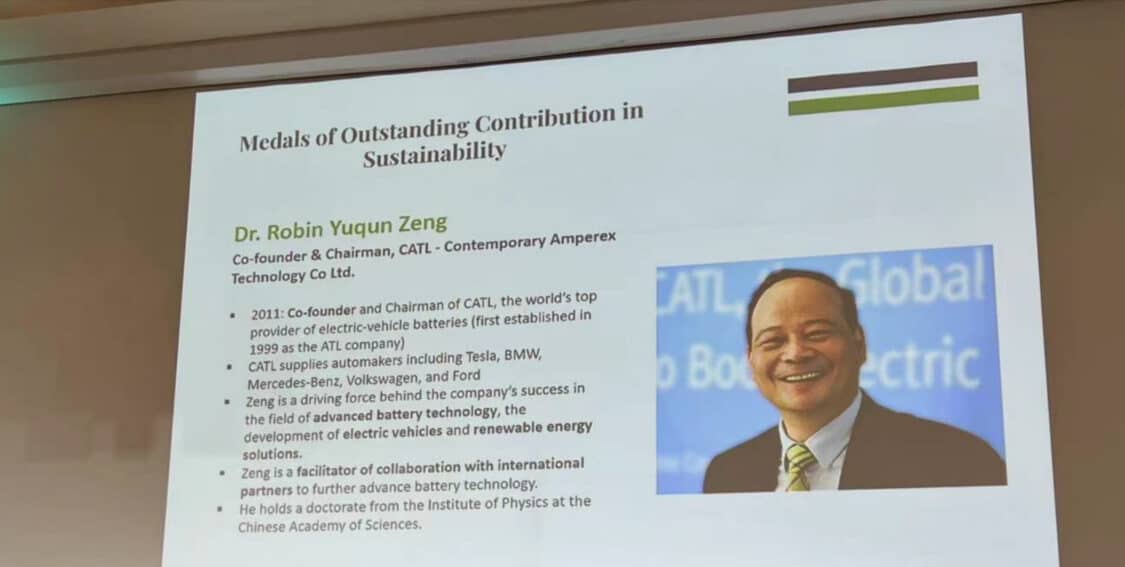

- Zeng Yuqun, CATL’s founder, is one of the wealthiest men in the world with a fortune of over $34 billion.

If you drive an EV anywhere in the world, the odds are good that it has a battery from Contemporary Amperex Technology Company Limited — also known as CATL. The global battery leader opened in 1999 as “ATL” when it began developing lithium-ion batteries.

ADVERTISEMENT

In 2011, CATL opened, and a year later the company developed a partnership with BMW. Now, the EV battery manufacturer works with Daimler AG, Hyundai, Honda, Tesla, Toyota, Volkswagen, and more.

This battery manufacturer isn’t just making batteries, but it’s also involved in recycling lithium-ion batteries through Brunp Recycling, which CATL purchased in 2015. CATL is dedicated to sustainability, and in 2022 its Yibin Plant became the world’s first zero-carbon battery factory. With four carbon-neutral plants, the company is close to achieving its 2025 goal of complete carbon neutrality in its core operations.

The Gigafactories in Germany

In 2019, the battery giant broke ground in central Germany to build a $2 billion CATL battery gigafactory for BMW and Volkswagen. The factory covers 57 acres and has the capacity to build batteries for hundreds of thousands of cars annually. CATL began building this assembly facility when it was still a young, 8-year-old company.

The German automakers decided to jump on the EV train to reduce emissions ahead of the timeline set by the European Union to reduce carbon emissions from gas-powered vehicles. Germany did not have a native battery manufacturer, so it had no choice but to turn to the Chinese battery maker. Tesla also began building a gigafactory outside of Berlin at the same time that CATL was building its factory.

ADVERTISEMENT

Welcoming a Chinese technology company into Germany was a sign that the automotive industry was changing. Germany was the place where the four-stroke internal combustion engine was invented, and Detroit was where the modern assembly line was developed. China was now taking the reins with the foundation of the EV market — the lithium-ion battery.

Building the factory in Germany gave the Chinese company the foothold it needed in the European Union. A few years after opening the plant, CATL became the battery supplier for nearly all EV manufacturers including nearly all Chinese EV companies, taking the lead in the movement from fossil fuels to renewables.

Who Is Zeng Yuqun?

While protesters were marching in Tiananmen Square in 1989, a man named Zeng Yuqun (also known as Robin Zeng) was exploring the benefits of capitalism. He moved to Dongguan to connect to global supply chains and watch British television from Hong Kong. At this time, Hong Kong was still under British control, and Dongguan to the north benefited from British imperialism and capitalism. While in Dongguan, Yuqun took advantage of the geographic location to learn about foreign investments, building factories, and developing a dream.

Before arriving in Dongguan and finding work at SAE Magnetic, owned by Liang Shaokang, he studied engineering in Shanghai and received a doctorate in condensed matter physics in Beijing. He could’ve worked in a state-owned country, but he wanted to set out on his own. While working at SAE Magnetic, he learned about batteries.

After 10 years in Dongguan, Liang Shaokang encouraged him to begin a battery company. Zeng did just that, as he began ATL in Hong Kong to manufacture batteries for the burgeoning mobile electronics industry. ATL made small lithium batteries for mobile phones and chargers. His company turned a profit in just a few months, as the company developed a lithium polymer battery that could be shaped to fit in any device. It outperformed competitors from Korea and the U.S., turning a profit in only a few months.

ADVERTISEMENT

What Is CATL?

In the early 2000s, Japan was the global battery leader, but China was moving up in the ranks. In 2001, China joined the World Trade Organization, allowing foreign nations to invest in Chinese companies. In the same year, ATL was making batteries for portable DVD players and Bluetooth devices. Ten years later, Zeng opened CATL to get into the automotive battery industry. Six years after that, it took the lead over Panasonic, then expanded into the German automotive market. CATL dominates the global battery industry because it makes a quality product at a higher scale and lower cost.

By 2022, CATL was supplying batteries to several automakers. It also purchased stakes in necessary natural resources around the globe: nickel in Indonesia, cobalt in the Democratic Republic of the Congo, and lithium in Australia. At this point, Zeng was the 30th richest person in the world with a net worth of over $34 billion. Zeng’s wealth and CATL’s dominance showed how the automotive giants in the United States and Germany dropped the ball on automotive battery production.

A Story of Efficiency and Innovation

CATL dominates the industry because it functions efficiently and embraces innovative technology. In 2021, the World Economic Forum awarded the Ningde factory and headquarters as a Global Lighthouse Factory for its use of advanced technologies. The Ningde factory uses artificial intelligence, 5G, cloud computing, and advanced analytics to scale productivity while maintaining exceptional quality and safety standards.

The company hasn’t struggled with supply chain issues like other global companies have. It has invested in raw materials as no other company has done. CATL has more than half of the metal-refining capacity needed for battery manufacturing, including 93% of the manganese and 100% of graphite needed for lithium-ion batteries.

CATL has invested in maintaining its position as a global leader in battery manufacturing. Along with building new batteries, the company’s recycling unit can recycle 90% of lithium and 99% of cobalt, nickel, and manganese. CATL is also invested in innovation, as it holds more than 4,400 patents.

ADVERTISEMENT

How the Inflation Reduction Act Could Change the Industry

The United States’ Inflation Reduction Act is pushing U.S. automakers to move away from CATL batteries. In 2024, drivers purchasing new EVs cannot take advantage of the $7,500 tax credit if the EV has batteries made in China. Companies like General Motors, Ford, and Hyundai are busy building battery factories with components extracted, processed, or recycled in the U.S. or a country with a free trade agreement.

Hyundai is building a battery factory in Georgia, while Ford plans to build one in Marshall, Michigan. GM builds batteries for its Ultium platform in Lordstown, Ohio, and it is building plants in Spring Hill, Tennessee, and Lansing, Michigan. Without domestic mining and processing, it will be difficult for U.S. battery plants to put a dent in CATL’s dominance. In fact, CATL is expected to train workers at a new Ford battery plant that will eventually open in Michigan.

The United States has several large lithium deposits which could give domestic battery manufacturers a leg up. The Salton Sea in California has upwards of 3.4 million tons of lithium — enough to power 375 million EVs. Currently, the U.S. produces less than 7% of lithium batteries, while China makes 80% of them, with CATL as the largest EV battery manufacturer.

Competition in China

U.S. companies aren’t the only EV battery manufacturers trying to dethrone CATL. A small battle between CALB vs. CATL is taking shape. CALB has developed a U-shaped battery and holds only 3.7% of the EV market share. CATL is also keeping its eyes on BYD, as the EV manufacturer is creating a wedge in the Chinese EV battery market with its new Blade battery.

ADVERTISEMENT

IMAGES: CATL

FTC: We use income-earning auto affiliate links. Learn more.

2 Responses