- Tesla produced 470,000 vehicles in Q3 2024, including 443,668 Model 3 and Model Y electric vehicles.

- Energy storage deployments increased with 6.9 GWh deployed in Q3 2024.

- Tesla plans to launch more affordable EV models by 2025, with projected vehicle sales growth of 20-30% next year.

Tesla’s Q3 2024 earnings call was full of big news, and one thing is clear: Tesla is breaking new ground in energy, self-driving cars, and manufacturing. Despite the challenges of rising interest rates and affordability concerns hitting the auto industry, Tesla is still growing. Elon Musk and the Tesla leadership team laid out a vision that’s a mix of big ambitions and grounded realities, and it’s hard not to feel like you’re getting an inside look at what’s coming next. And the real takeaway is it’s not just about cars anymore.

ADVERTISEMENT

The Financial Breakdown: Tesla’s Still Winning

Tesla posted record deliveries in Q3 2024, during a time when many electric vehicle (EV) companies are struggling to turn a profit. Musk didn’t shy away from that point, “To the best of my knowledge, no EV company is even profitable, and no EV division of any existing company is profitable.” He stressed that Tesla is profitable in this challenging environment despite the headwinds.

For a more specific look, Tesla produced 469,796 electric vehicles (EVs) in Q3 2024 and delivered 462,890 vehicles, according to the report. These numbers reflect their continued growth and ability to meet the rising demand, even as many other manufacturers struggle. Model 3 and Model Y were the stars of the show, with 439,975 units delivered alone, while Model S, Model X and Cybertruck saw a total 22,915 deliveries.

Tesla’s automotive revenues grew year-over-year, though they did experience a reduction in average selling prices (ASPs), primarily due to financing incentives. But here’s the kicker: those incentives are structured through third-party banks, so Tesla absorbs the cost upfront but doesn’t carry it for long. In typical Tesla fashion, even the hurdles seem to be carefully calculated.

As CFO Vaibhav Taneja pointed out, “Our Q3 results were overall positive and once again demonstrate the skill with which the business has evolved over the years.” Tesla brought in $6.3 billion in operating cash flow, showing that even with price cuts and rising production costs, they’re still in solid control of their finances.

Cars That Drive Themselves (For Real This Time)

Now, for the fun part – autonomous driving. Tesla’s Full-Self Driving (FSD) software continues to improve, with Version 12.5 already out and Version 13 just around the corner. Tesla executives are confident that within a few months, their cars will require fewer driver interventions than those driven by humans. The internal estimates point to achieving that milestone by Q2 2025, though Musk adds a caveat, “It may end up being the third quarter, but it’s next year.”

Autonomy took center stage at the 10.10 event in October, where Tesla showcased fully autonomous “Robotaxi” Cyber Cabs and Model Ys transporting thousands of people without a single incident. No steering wheels, no pedals, it was just fully autonomous. Musk highlighted, “The whole night went very smoothly,” which, considering the scale of the event, is no small feat. If this event is a sign of what’s coming, Tesla could soon be operating robotaxis at a much larger scale.

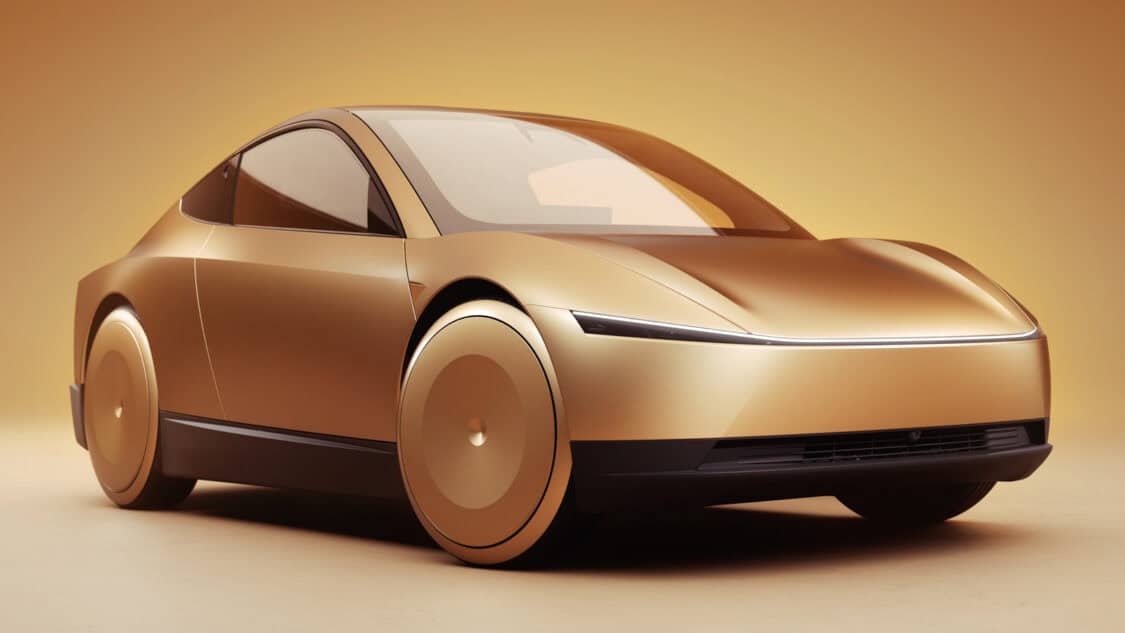

And for those wondering when Tesla will release its more affordable models, Musk reiterated that they’re on track to launch by 2025. He estimates vehicle sales growth of 20-30% next year, which is a confident forecast considering the tough market conditions right now.

ADVERTISEMENT

Tesla’s Not Just About Cars: MegaPack Demand Soars and Factories Ramp Up

What’s often overlooked is Tesla’s energy business, which is growing just as fast. Energy storage is exploding, with MegaPack and Powerwall demand off the charts. Tesla deployed 6.9 GWh of energy storage in Q3 2024, a substantial increase year-over-year.

And the GigaFactory in Reno is pumping out 200 MegaPacks every week, which adds up to a huge 40 GWh per year, with a second factory in Shanghai expected to come online with a 20 GWh annual run rate in Q1 2025. Musk confidently stated, “It won’t be long before we’re shipping 100 gigawatt hours a year of stationary storage.”

The company’s energy margins hit more than 30% in Q3, thanks to a mix of projects that are pushing Tesla’s profitability even higher. It’s a side of the company that doesn’t always grab headlines, but its growth is impossible to ignore.

Tesla Targets for $30K EV and Reinvents Car Production by 2025

Tesla’s Q3 call gave us a clearer picture of their goal to roll out more affordable models by 2025, including one priced under $30,000. This is a big deal, especially once subsidies are factored in. According to Musk, “We’re aiming for two million units a year of Cyber Cab.”

Tesla is completely redefining how we get around and how cars are made, with plans to ramp up production in a way no other automaker has even tried before. Musk described their new manufacturing process as “half an order of magnitude better” than current methods. Essentially, a totally new way of building cars.

As Musk summed up, “Tesla will become the most valuable company in the world, and probably by a long shot.”

So, if you’re wondering how Tesla is handling everything from autonomy to affordability, the answer is simple: they’re doing it all, and they’re doing it big.

ADVERTISEMENT

SOURCE | IMAGES: TESLA | ELECTRIFY EXPO

FTC: We use income-earning auto affiliate links. Learn more.