- Tesla Model 3 1.99% APR financing offer ends on August 31, 2024.

- Leasing offers lower payments and flexibility, while financing provides ownership and long-term cost benefits.

- New York buyers can reduce the Tesla Model 3 cost with a $7,500 Federal Tax Credit and a $2,000 state incentive.

More drivers are now facing the choice between leasing or financing their next car. This decision is especially relevant with the Tesla Model 3 refresh, known for its new front headlights and taillights, balanced performance and optimized range. With promotional offers ending soon and new incentives coming up, it’s a great time to carefully consider your options.

ADVERTISEMENT

Should You Lease or Finance the New Tesla Model 3?

The Tesla Model 3, especially the Long Range Rear-Wheel Drive, really makes a statement on the road. Featuring a 363-mile range (EPA estimate), a top speed of 125 mph, and an impressive 0-60 mph in just 4.9 seconds, it’s no wonder this model continues to dominate the EV market. The price might be a concern for some, starting at $44,130 before any incentives. The key decision is whether to finance this stylish vehicle or opt for Tesla’s appealing leasing options.

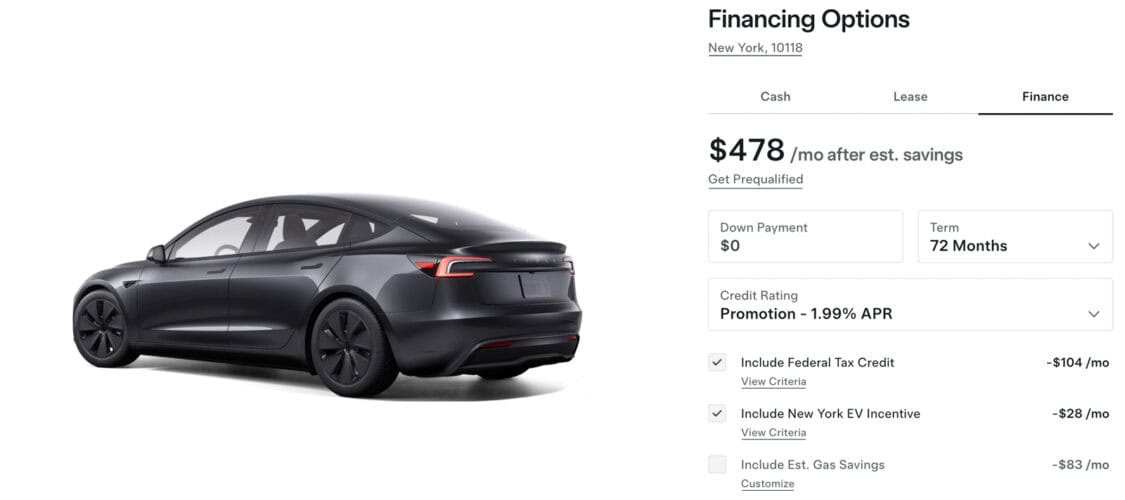

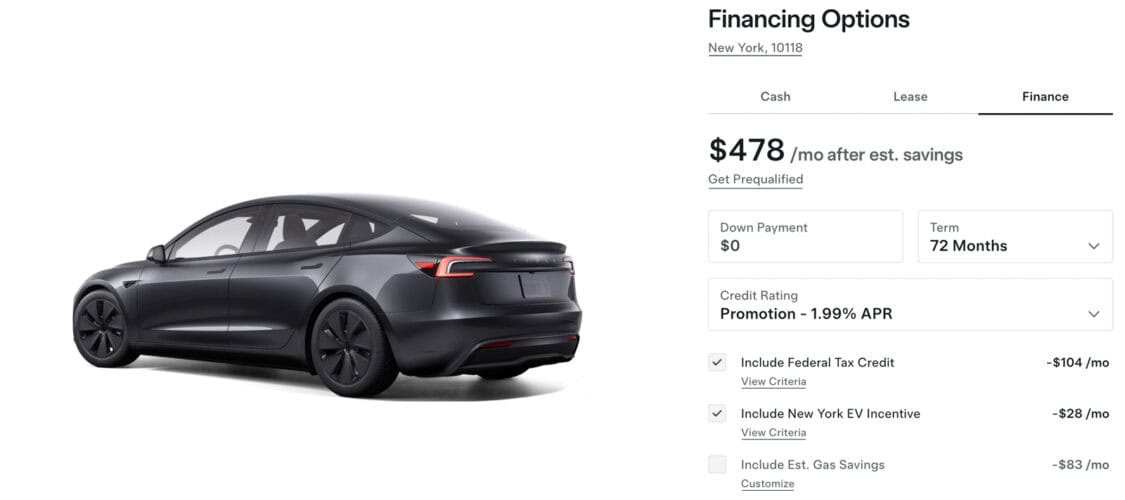

Financing can be a smart move, especially with Tesla’s current offer of a 1.99% APR, valid until August 31, 2024. This promotional rate is a steal for well-qualified buyers with excellent credit, potentially bringing your monthly payments down to around $478 after estimated savings, with no down payment required.

Over a 72-month term, this makes the Tesla Model 3 price more manageable, especially when you factor in the estimated $5,000 in gas savings over five years, the $7,500 Federal Tax Credit, and state incentives that can knock off an additional $28 per month for New York residents.

However, it’s important to note that not all buyers will qualify for this low APR. Tesla’s financing options come with a variety of rates depending on your credit score. The monthly payments presented are estimates and can change based on credit approval and available rates at the time of your application. Also, financing doesn’t include the supercharging incentive, so if that’s a priority, you might want to consider leasing instead.

Leasing, on the other hand, offers flexibility, especially for those who prefer driving a new car every few years. Tesla’s lease option for the Model 3 in New York, for example, starts at around $512 per month after savings, with $0 down payment and 10,000 miles annually. While leasing generally results in lower monthly payments than financing, it comes with the drawback that you won’t own the vehicle at the end of the lease term.

Instead, you’ll return the car to Tesla after 36 months, potentially facing early termination fees or charges for excessive wear and mileage overages. But for those who value driving the latest models and don’t mind switching vehicles frequently, leasing could be the way to go.

Breaking Down the Costs: Is Leasing or Financing Better for You?

While leasing might seem attractive due to the lower upfront costs and monthly payments, it’s essential to consider the long-term financial impact. Financing a new Tesla Model 3 for sale allows you to take full ownership of the car. This means after you’ve paid off the loan, you can enjoy your Tesla without any further monthly payments—something that’s not an option with leasing.

And when you finance a Tesla Model 3, you’re also investing in a future-proof vehicle loaded with advanced features. With an MSRP starting at $44,130, the Model 3 comes packed with the latest technology, including Tesla’s renowned Full Self-Driving capability (available for an additional $8,000). For those who value having the latest tech and want to customize their vehicle, financing is likely the better option.

ADVERTISEMENT

Tesla also makes financing appealing by including federal and state incentives. In New York, for instance, the Federal Tax Credit could reduce your monthly payments by $104, while the state’s EV incentive could cut an additional $28 per month. Combined with estimated gas savings of $83 per month, these incentives can make financing a new Tesla Model 3 more accessible than ever before.

Leasing still holds its appeal, particularly for drivers who aren’t interested in long-term ownership. The lower monthly payments and the freedom to upgrade to a new model every few years without worrying about selling your old car are significant benefits. Plus, Tesla’s lease agreements are available in most states, making it a convenient option for many drivers.

Considering a Used Tesla Model 3?

With the used Tesla Model 3 market growing rapidly, there’s another option to consider. Prices for used EVs, including the Tesla Model 3, are dropping fast, making them more accessible to a broader audience. This trend could make financing a used Model 3 a cost-effective alternative to buying new, especially if you’re looking to balance budget with performance.

What Tesla Has to Say

According to the Tesla website, they’re committed to making electric vehicles more accessible to everyone, and their financing options are designed to meet the diverse needs of their customers. This commitment is reflected in the various incentives and promotional rates currently available, but remember, these offers are time-sensitive—particularly the 1.99% APR financing rate, which ends on August 31, 2024.

Making the Right Choice

Whether you’re drawn to the lower monthly payments of a lease or the long-term benefits of financing for the Tesla Model 3, the decision ultimately comes down to your personal preferences and financial situation.

With the clock ticking on Tesla’s current promotional offers, now is the time to decide—will you take the leap into the future with a leased Model 3, or will you invest in ownership through financing? Either way, you’re choosing one of the most innovative and exciting vehicles on the road.

And to make the most informed decision, consider test-driving the Model 3 at the upcoming Electrify Expo.

ADVERTISEMENT

IMAGES: TESLA, ELECTRIFY EXPO

FTC: We use income-earning auto affiliate links. Learn more.