- Tesla’s Q2 2024 production dropped over 15% and deliveries decreased by 5%.

- Tesla’s market share fell in 2024 due to increased competition from other automakers.

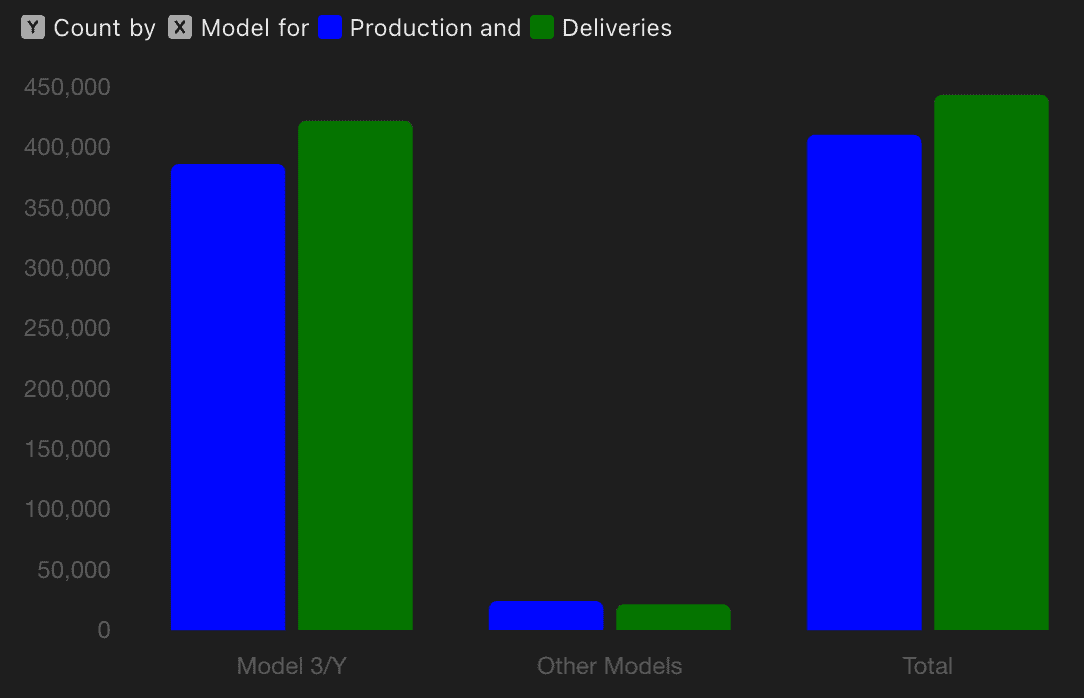

- 95% of Tesla’s sales come from just the Model 3 and Model Y.

Tesla’s Q2 2024 production and delivery report has raised more than a few eyebrows. Elon Musk, the man who can make or break Bitcoin with a tweet, recently celebrated a massive payday. Yet, behind the scenes, Tesla is navigating some choppy waters.

ADVERTISEMENT

Numbers Tell the Tale: Tesla’s Q2 2024 Report

In the three months ending in June, Tesla rolled out 410,831 vehicles, a significant 16.76% dip compared to Q2 2023. Even more concerning, deliveries to eager customers hit 443,956, down 4.99% from last year. For a company known for its sky-high ambitions, this trend, which started earlier in 2024, raises eyebrows. So, what’s going on?

The EV Market is Crowded – And Tesla Isn’t Alone Anymore

Tesla’s struggles aren’t just about production hiccups at its Fremont factory or supply chain snags at the Berlin Gigafactory. The EV playground is more crowded than ever. Legacy automakers are rolling out new electric models like they’re going out of style, chipping away at Tesla’s once-dominant market share. Remember when Tesla had an 80% stranglehold on the market in 2019? In 2023, it was a different ballgame, with Tesla holding onto about 55%, according to Cox Automotive.

Q2 2024 Production Woes and Market Competition: A Double Whammy

Tesla’s production issues, like the slow roll-out of the refreshed Model 3, only tell half the story. Despite a 14.78% sequential increase in deliveries from Q1, Tesla’s market share is slipping as competitors like Hyundai and GM gain ground.

Tesla Q2 2024 Production And Deliveries:

| Model | Production | Deliveries |

| Model 3/Y | 386,576 | 422,405 |

| Other Models | 24,255 | 21,551 |

| Total | 410,831 | 443,956 |

The Musk Effect: When Your CEO is a Meme

Musk’s online antics and polarizing tweets don’t help. Love him or hate him, his behavior impacts Tesla’s brand. Coupled with gaps in the vehicle lineup and increasing competition, Tesla’s reliance on the Model 3 and Model Y for 95.13% of its sales seems risky. And the much-hyped Cybertruck? It’s as divisive as pineapple on pizza.

Beyond Cars: Energy Storage and the AI Future

Despite the setbacks, Tesla’s energy storage game is on point. In Q2 2024, they deployed a record 9.4 GWh of energy storage products. “We deployed 9.4 GWh of energy storage products in Q2, the highest quarterly deployment yet,” the report mentioned. Energy storage might not be as flashy as a new car, but it’s crucial for sustainable energy infrastructure.

And with the big robotaxi reveal on August 8th, Musk is pivoting Tesla into an AI and robotics powerhouse. But until that future arrives, the company’s bread and butter remains its cars.

Looking Ahead: Earnings and More Layoffs

As Tesla navigates the aftermath of multiple rounds of layoffs, all eyes are on the upcoming Q2 earnings report on July 23rd. It’s going to be a busy summer for Tesla, balancing the immediate challenges with future promises.

ADVERTISEMENT

IMAGES: ELECTRIFY EXPO

FTC: We use income-earning auto affiliate links. Learn more.