- Tesla’s Q3 revenue of $23.4 billion missed Wall Street’s $24.06 billion estimate.

- Cybertruck deliveries are set to start in November.

- Tesla aims to produce 1.8 million vehicles in 2023, with 1.3 million already delivered.

So, what’s the real deal with Tesla’s Q3 2023 earnings report? At first glance, it’s a mixture of missed expectations and silver linings. But let’s dive deep, break it down, and make sense of it all.

To kick things off, Tesla’s Q3 performance didn’t exactly hit the bullseye. With a reported top-line revenue of $23.4 billion, they fell short of the Wall Street estimates of $24.06 billion. To put it bluntly, the electric-vehicle kingpin missed the mark, but there’s more to the story than just numbers.

Sure, from a profitability standpoint, there were hiccups. A reported EPS of $0.66 against an expected $0.74 was a curveball. And the adjusted net income? Sitting at $2.3 billion versus the hoped-for $2.56 billion. The fact that this is nearly 30% lower than a year ago is a detail that can’t be ignored. But here’s a thought, maybe it’s tied to Tesla’s ambitious cost-cutting efforts from the previous year. Their Q3 gross margin was a hair away from the expected, coming in at 17.9% against the estimated 18.0%.

ADVERTISEMENT

But not everything is gloomy. Transitioning to brighter news, Tesla is still very much on track with their 2023 production goal of 1.8 million vehicles. And here’s a juicy tidbit: earlier this month, Tesla announced a whopping 435,059 vehicle deliveries globally. Majority of these were the Model Y and Model 3 variants. However, it’s worth noting that Wall Street was looking for a slightly bigger number, approximately 456,722.

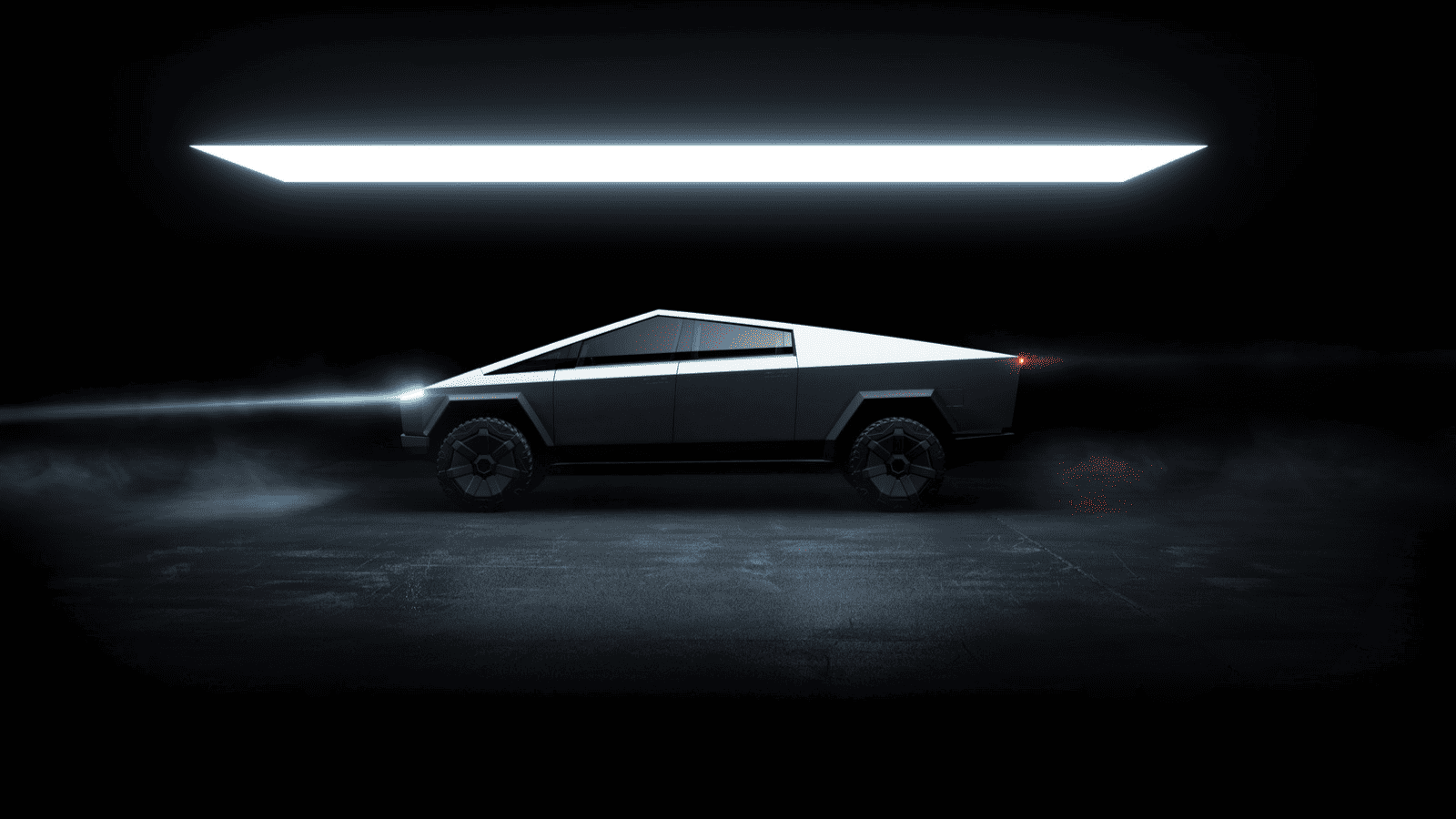

So, what’s the deal for the future? Tesla’s Cybertruck is gearing up to hit the roads. Deliveries are all set to begin in November. Although the much-anticipated Q3 delivery event was a no-show, the company has assured that Model Y production is bound to surge at Giga Austin and Giga Berlin.

Let’s talk numbers again. The Wall Street consensus? They pegged this quarter’s revenue at a staggering $24.256 billion with earnings of $0.73 per share. The real question was, did Tesla meet, beat, or miss the expectations? The answer? They met it, but with a slight stagger, reporting an earnings of $0.66 per share and revenue of $23.35 billion.

ADVERTISEMENT

Interestingly, despite the earnings miss, Tesla has showcased resilience. As the report mentions, “Our cost of goods sold per vehicle decreased to ~$37,500 in Q3.” The company’s adaptability is evident with their cost reductions, emphasizing that “an industry leader needs to be a cost leader.”

In other details, Tesla’s gross margin took a minute dip from 18.2% to 17.9%, but they managed to maintain a positive cash flow with a nifty addition of $0.8 billion this quarter. Plus, with over $26 billion tucked away, Tesla’s financial pillow is pretty plush.

To sum it all up, while the earnings report shows a few stumbles, it’s crucial to view it in the grander scheme. The company’s bold innovations, like the “stalkless” turn signal in the updated Model 3 “Highland” sedan or its Full Self-Driving option, show they’re pushing boundaries. Yes, they might have missed a few targets, but as with all endeavors, there are peaks and valleys.

As the anticipation builds for the next quarter, the big question remains: Will Tesla rise to the challenge? Only time will tell. But given their track record, I wouldn’t bet against them.

Tune in to Tesla’s Q3 2023 results conference call:

SOURCE | IMAGE: TESLA

FTC: We use income-earning auto affiliate links. Learn more.