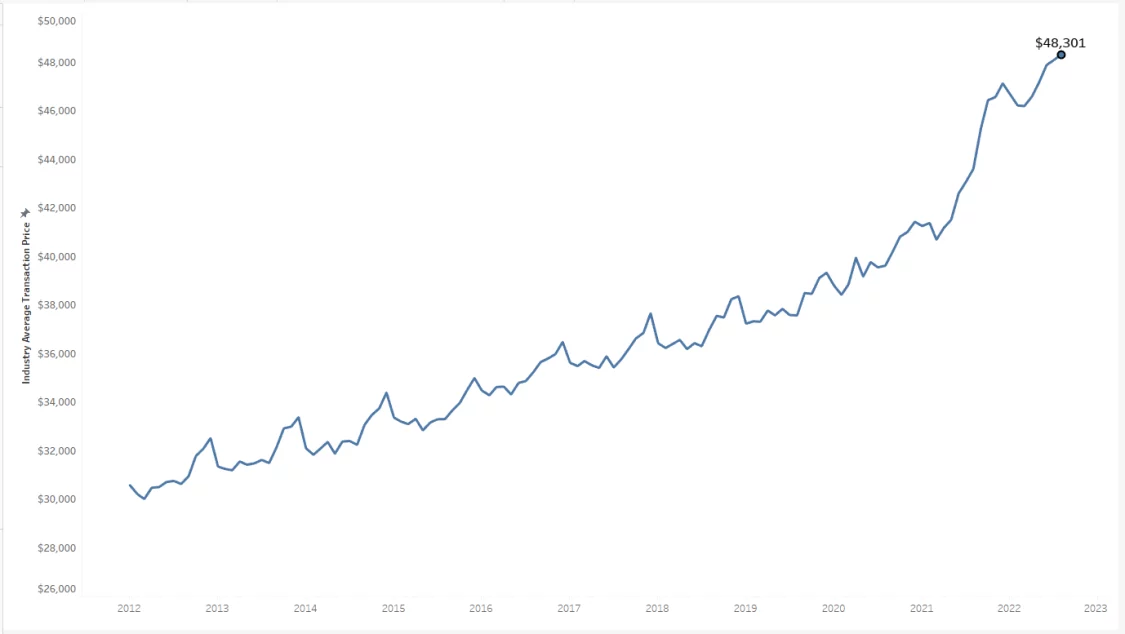

Shopping for a new car? If you are, get ready to pay — the average transaction price for a new car is now a record $48,301!

The average price paid for a new vehicle is breaking records month after month, with August’s average transaction price at around $48,301 according to Kelly Blue Book.

August of 2021’s average transaction price was $4,712 less than this, meaning a year over year increase of 10.8%. August of 2022 is up $222, or 0.5% compared to July’s $48,080, which was also a previous high from the month prior — a trend that’s continued for the last 5 months. (!)

Average New Car Transaction Price Chart

The average price paid for a new non-luxury vehicle in July was a record high $44,559, up $132 month over month. Non-luxury buyers paid around $1,100 and nearly 2% above MSRP in August, both increases from prior months. Luxury buyers also saw average transaction price increases in August, with that value also hitting a new record of $65,057, up $878 from July. Luxury vehicle share is also historically high, but did decrease to 17.5% in August from 17.7% of total sales in July. This high share also pushes the average transaction price of the industry as a whole higher.

The average price for electric vehicles rose by 1.7% from July to August and 15.6% over the year. EVs on average still cost quite a bit more than the industry average, at around $66,000.

Research manager of economic and industry insights for Cox Automotive Rebecca Rydzewski says “Prices are still high and climbing incrementally every month, New-vehicle inventory levels have been rising through August, now reaching the highest level since June 2021. However, supply of popular segments (like subcompacts, hybrids, and EVs) still remain very low. Automakers are focusing on building and selling high-margin vehicles. Essentially, the product mix is the primary factor keeping prices high.”

Speaking of inventory, new-vehicle day’s supply was held steady in the mid to high 30s over the summer but is now showing signs of increasing. Inventory shortages first started to affect the market around August of 2021, and as of August of this year, day’s supply was 43% higher than that. This is still far lower than the levels in 2020 and 2019. 2022 is averaging 1.1 million units per month in sales, while the first eight months of 2019 averaged 1.4 million.

In terms of price strength in the market, Hyundai, Land Rover, Honda, and Kia continue to dominate, transacting between 5 and 9% over sticker last month.

The companies with the least price strength, with models selling for 1% or more below MSRP in August included RAM Trucks, Volvo, Lincoln, Buick, Alfa Romeo, and Fiat. These companies also have the highest dealer supply of vehicles.

Incentives are at a historically low 2.3% of the average transaction price, decreasing from July to August, and decreasing heavily from this time in 2021, when incentives were at 5.5% of average transaction price. Different groups tend to have different incentive levels, with full size-cars and luxury cars having the highest incentives, and high-performance cars, vans and EVs having the lowest. Inventory levels also affect incentives, i.e. brands with higher inventory levels average higher incentives and vice versa. Stellantis is a good example of this, with higher average inventory and higher average incentives at around 4.4% of average transaction price (up from 4.1% in July).

So, high prices everywhere. There is one positive here, though. The higher gas prices over the summer have worked to drive down demand on full-size pickups, so if that’s what you’re shopping for, on average you’ll end up paying $142 below sticker.

SOURCES | IMAGES: KBB, COX AUTOMOTIVE.

FTC: We use income-earning auto affiliate links. Learn more.