- Canada cut Chinese EV tariffs from 100% to 6.1% with an initial cap of 49,000 vehicles.

- China plans to lower canola seed tariffs from 84% to roughly 15%.

- The agreement unlocks close to 3 billion dollars in Canadian agricultural exports.

ADVERTISEMENT

Canada just did something that made a lot of people spit out their coffee. It cut electric vehicle tariffs on Chinese imports from an eye-watering 100% down to 6.1%, with a cap that starts at 49,000 vehicles and rises over time.

This came straight from Prime Minister Mark Carney during his Beijing visit, the first by a Canadian Prime Minister since 2017. Reuters broke the news, and yes, it raised eyebrows on both sides of the Pacific.

This decision walks away from the protectionist logic used by the previous government and replaces it with a pragmatic view of how electric vehicles actually scale.

ADVERTISEMENT

Carney said it himself, and Reuters quoted him directly, “For Canada to build its own competitive EV sector, we will need to learn from innovative partners, access their supply chains, and increase local demand.”

Canada wants lower priced EVs people can buy today, rather than factory plans that might pay off a decade from now.

Let us pause for a second and talk numbers, because feelings aside, math always wins. China shipped 41,678 EVs to Canada in 2023, even with political tension in full swing. The new quota allows more than that immediately and grows to roughly 70,000 units within five years.

Those vehicles come in at price points Canadian consumers rarely see, often undercutting Western brands by thousands of dollars while still offering long range lithium iron phosphate batteries, advanced driver assistance, and modern infotainment.

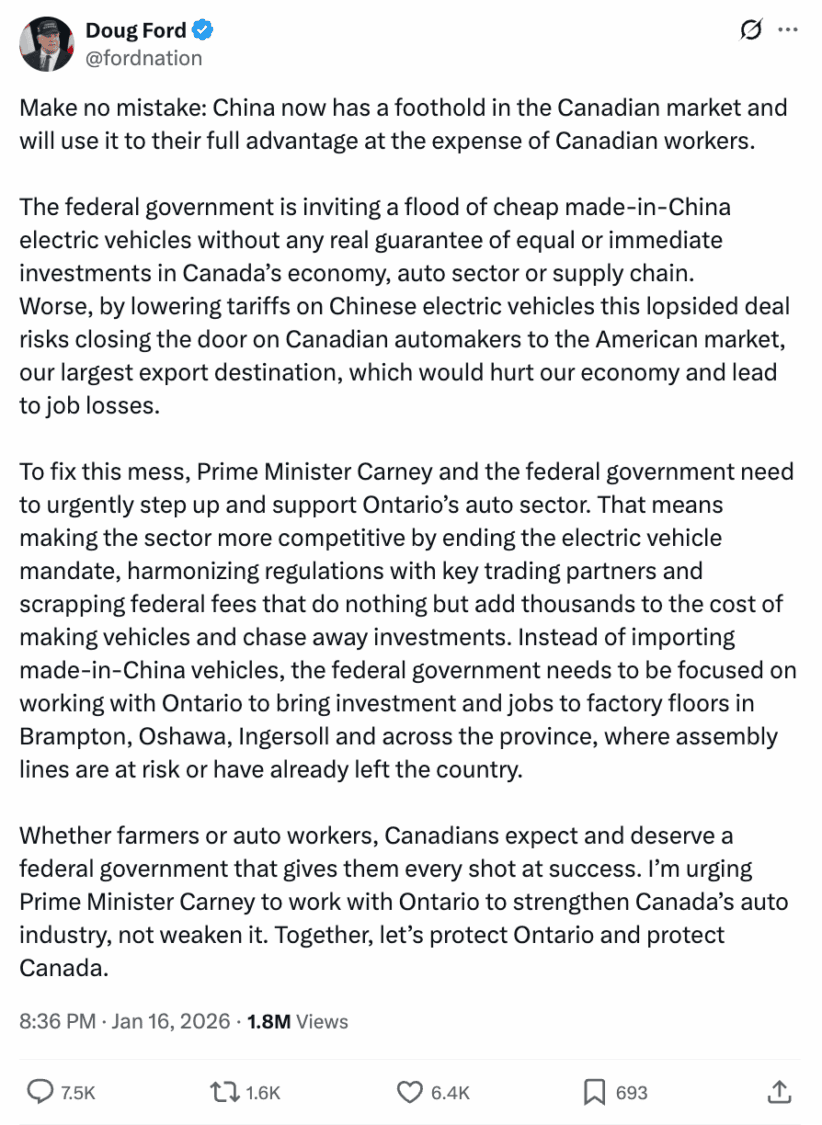

Critics jumped fast. Ontario Premier Doug Ford blasted the decision online on X, warning of cheap imports flooding the market without guaranteed local investment. That concern resonates emotionally, especially in auto towns that still carry scars from past trade deals.

Yet here is the uncomfortable truth. Canadian EV adoption has stalled partly due to price fatigue. Incentives help, but sticker shock remains real. Lower priced electric cars expand the buyer pool, and a bigger buyer pool supports charging infrastructure, service networks, and secondary markets. Those pieces matter for domestic manufacturing survival.

The canola side of the deal rarely gets EV headlines, yet it explains the timing perfectly. After Canada raised EV tariffs under Justin Trudeau, China retaliated with tariffs as high as 84% on Canadian canola seed and hit seafood exports hard.

ADVERTISEMENT

Canadian farmers paid the price. Under the new agreement, China plans to drop canola seed tariffs to roughly 15% and remove discriminatory duties on canola meal, lobster, crab, and peas through year end. Carney said these changes unlock close to three billion dollars in export orders.

This approach breaks from how Washington usually handles trade. Several members of President Donald Trump’s cabinet criticized it before the upcoming USMCA review.

Then Trump himself shrugged and backed Carney publicly. His words, via Reuters, “That’s what he should be doing. It’s a good thing for him to sign a trade deal. If you can get a deal with China, you should do that.”

When Trump sounds flexible on China trade, pay attention.

ADVERTISEMENT

Carney went further during the trip, calling recent dealings with Beijing predictable and productive. That statement alone triggered cable news debates.

Analysts are keeping their feet on the ground. Canada remains tightly tied into U.S. security and intelligence systems, and no sudden realignment appears likely.

Trade decisions, though, play out in everyday life. People care first about grocery bills, car prices, and reliable energy. Lowering friction helps on all three fronts.

Energy quietly threaded through the talks as well. Canada plans to double its energy grid within 15 years and ramp LNG exports to Asia to 50 million tonnes annually by 2030. Offshore wind and grid infrastructure came up as investment areas.

This context matters for EVs. A cleaner, larger grid supports electrification without reliability fears. That calms one of the most persistent consumer anxieties, range and charging confidence.

ADVERTISEMENT

Chinese electric vehicles already dominate global EV sales volume. Blocking them completely never insulated domestic brands from competition. It only delayed consumer exposure.

Letting a limited number of imports in, with guardrails, forces companies to get serious on pricing, software, and how well they actually build cars. Some rise to it. Others fall behind. History usually rewards the ones that adapt.

Reuters framed this deal as a reset in Canada China relations. That phrase fits. Trade friction helped nobody here, least of all drivers staring at five figure price tags and farmers stuck in tariff crossfire.

Electric vehicles win when they reach regular people. Not early adopters. Not policy debates. Regular drivers. Lower prices help that happen. Canada just acknowledged it out loud.

ADVERTISEMENT

SOURCES | IMAGES: REUTERS, COUNCIL OF FOREIGN RELATIONS, FORDNATION | ELECTRIFY EXPO

FTC: We use income-earning auto affiliate links. Learn more.